India's most valuable company, Reliance Industries Ltd (RIL), is likely to report a double-digit growth rate in consolidated earnings before interest, taxes, depreciation and amortisation (EBITDA) for the December-March quarter when it reports its earnings today, according to a Moneycontrol poll. The company has a 10.34 percent weightage on the Nifty 50 index.

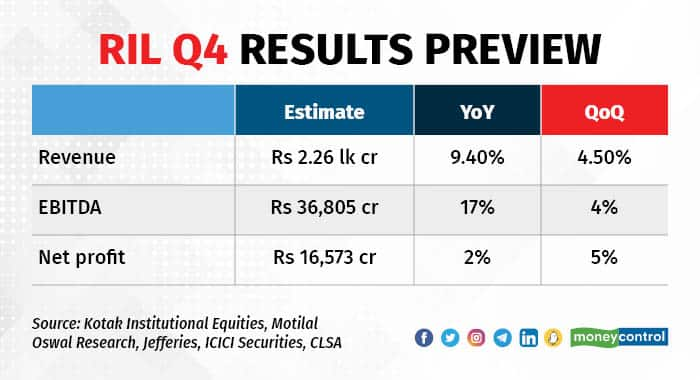

Operating profit is expected to come in at Rs 36,805 crore, up 17 percent from the year-ago period. As per estimates, topline and bottomline will grow in single digits, both sequentially and year-on-year (YoY). Consolidated revenue is seen at Rs 2.26 lakh crore and net profit at Rs 16,573 crore.

The growth in EBITDA will largely be on the back of a strong oil-to- chemicals (O2C) segment. Resilient gross refining margins, improvement in petchem margins on the back of China reopening and higher exploration and production (E&P) profitability on slightly higher gas production will drive the operating performance, said analysts.

Net profit growth is expected to rise only 2 percent YoY as the base quarter had no impact on the windfall tax. Foreign broking firm Jefferies estimates 28 percent YoY jump in taxes at Rs 5,625 crore.

That said, windfall taxes have been revised downwards several times since their imposition in July 2022. So, the biggest impact on the bottomline has already played out in the previous quarters.

Also read: Options Trade | An earnings-based non-directional options strategy in Reliance Industries

“A cooling crude price, pick-up in gasoline spreads and the near removal of the windfall tax has led to higher refining margins. Coupled with the start of phase-3 gas production from its eastern offshore block, this should drive oil and gas profits higher in the March and June quarters,” CLSA’s Vikash Kumar Jain wrote in a recent note.

The O2C segment’s EBITDA has been pegged at Rs 15,387 crore.

Retail and telecom

These two segments that have been powering growth for the diversified conglomerate are expected to continue their steady run. Reliance Retail's topline is likely to cross the Rs 70,000-crore mark with 35 percent YoY EBITDA growth at Rs 5,003 crore on the back of an increased store footprint and benefits of operating leverage.

In the quarter gone by, the company made rapid strides in the consumer segment. It launched a made-for-India consumer packaged goods brand, Independence, in Gujarat. It also relaunched and rolled out the iconic beverage brand Campa, after acquiring it from its owner Pure Drinks in August 2022.

On the other hand, the telecom segment’s EBITDA is expected to rise 14 percent YoY to Rs 12,803 crore for the March quarter. While Kotak Institutional Equities has pegged subscriber addition at 5.7 million, ICICI Securities sees it at 6.5 million. Meanwhile, the average revenue per user (ARPU) is expected to remain flat on a sequential basis at Rs 179 amid lower number of days.

“Further clarity on the Rs 75,000-crore investment in the new energy business, growth in retail store additions, and any pricing action in telecom are the key monitorables,” according to Motilal Oswal Financial Services.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.